Just a year ago, we talked about the age of IPOs and celebrated the wave of maturity among late stage startups. Twelve months later, after a record-breaking year for Indian startup IPOs and as we mark the fifth National Startup Day, it’s once again time for the startup ecosystem and the various stakeholders to recalibrate.

No one can deny that India’s startup ecosystem has grown at a scale and speed few countries have matched and this is exactly why the National Startup Day was brought in and till today, it remains one of the only instances of such a day in the world.

From a handful of early-stage ventures a decade ago, the country has now become the third-largest startup hub globally, hosting over 200,000 DPIIT registered startups across sectors. But there’s a new reality about to hit these stakeholders — from startup founders to investors to policymakers.

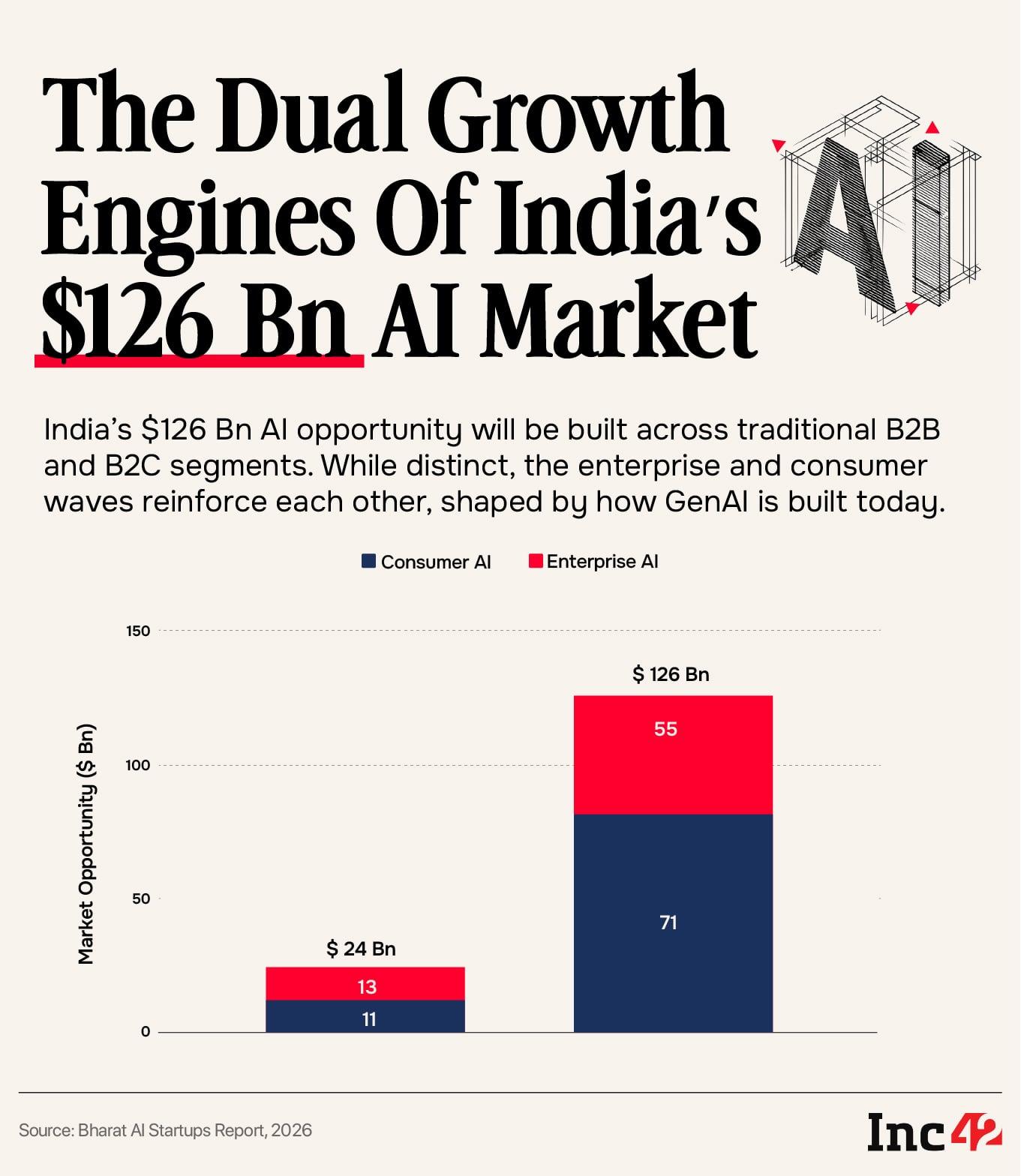

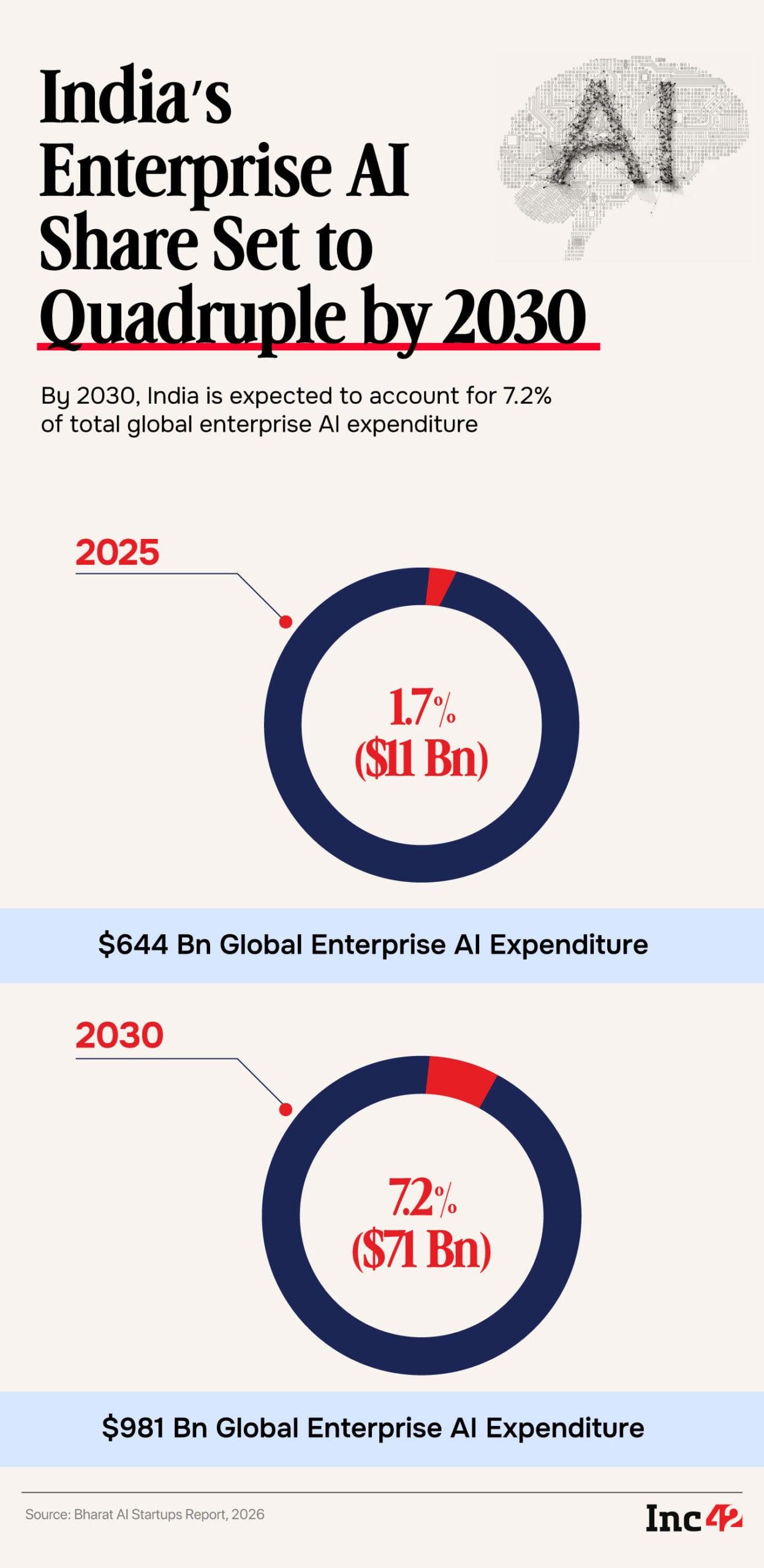

This National Startup Day, the focus has turned from businesses heading to IPOs to artificial intelligence, how Indian can build its sovereign AI stack and the massive $126 Bn AI opportunity in the next half a decade, as revealed in Google and Inc42’s comprehensive Bharat AI Startups Report, 2026

More than anything else, the report clearly spotlights a convergence of forces that is poised to take the Indian AI economy to new heights in the next decade.

The startup ecosystem has produced 126 unicorns and more than 147 soonicorns, VCs and private equity have poured billions and lawmakers have created policies that have led to new categories. But AI is about to change it all.

As always, Inc42 serves as the bridge between startups and policymakers, guiding the conversation and shaping the agenda. And this is exactly the right time for these stakeholders to work together to realise the full AI opportunity.

The Government Lens: Infrastructure Push

Over the past two years, the government of India has taken an ambitious, multi-pronged approach to AI, led primarily by the Ministry of Electronics and IT (MeitY) via the IndiaAI Mission, approved in March 2024 with INR 10,371.92 Cr outlay to be spent in five years.

Thanks to that, compute capacity in India has been expanded from 10,000 to 38,000 GPUs, which are available at subsidised rates for researchers and startups, supported via public-private partnerships and an AI marketplace.

On the data side, platforms such as AIKosh now host more than 5,500 datasets and 250-plus AI models spanning 20 sectors, while the government has backed early foundational AI efforts by startups such as BharatGen, Sarvam AI and Soket AI, which are building large-scale, multilingual models tailored for Indian languages and use cases.

But according to CoRover.ai founder and CEO Ankush Sabharwal, the government is doing much more than what the headlines might reveal. Behind the scenes, there are several programmes that are spurring on early stage startups.

For instance, in one of the government-backed global go-to-market programmes, a small cohort of Indian AI startups was placed in fully funded accelerator-style residencies overseas, including a three-month programme at Station F in Paris, run in collaboration with European institutions.

In CoRover’s case, this resulted in direct enterprise customer acquisition in France, underscoring that these efforts are intended to deliver commercial outcomes rather than serve as symbolic showcases.

The government has also been collaborating with global AI giants like OpenAI, Google, among others. For instance, Google yesterday announced the Market Access Program, to help Indian startups access global markets.

“AI is opening whole new customers that you never thought of before, media companies, agriculture firms in Europe, companies we’ve never worked with. The biggest gap for Indian startups today is access, getting in front of these decision-makers, because that’s where the revenues will actually come,” Seema Rao, managing director at Google, told Inc42.

At home, MeitY has issued multiple requests for proposals (RFPs) to onboard AI service providers, foundation model builders and application-layer startups onto government panels, mirroring its approach to cloud and GPU procurement.

Notably, selected startups have received targeted grants, typically ranging between INR 25 Lakh and INR 40 Lakh to build real-world AI applications.

“The government has done almost everything one can expect, GPUs, grants, equity funding, international exposure, policies. But meaningful AI startups are still very few. The gap is not intent; the gap is real problem-solving,” says Sabharwal .

Further, building on the international forums like UK AI Safety Summit, India is hosting the AI Impact Summit next month, looking to turn high-level commitments from various governments around the world into a consensus and tangible progress. The summit will look to advance global AI cooperation while empowering the voice of the global south, and also giving more clarity to regulations in AI.

Where Is Innovation Heading?

As of late 2025, more than 150 Indian startups have launched AI-first products across generative AI, voice, and conversational systems, among other areas, according to Inc42 analysis.

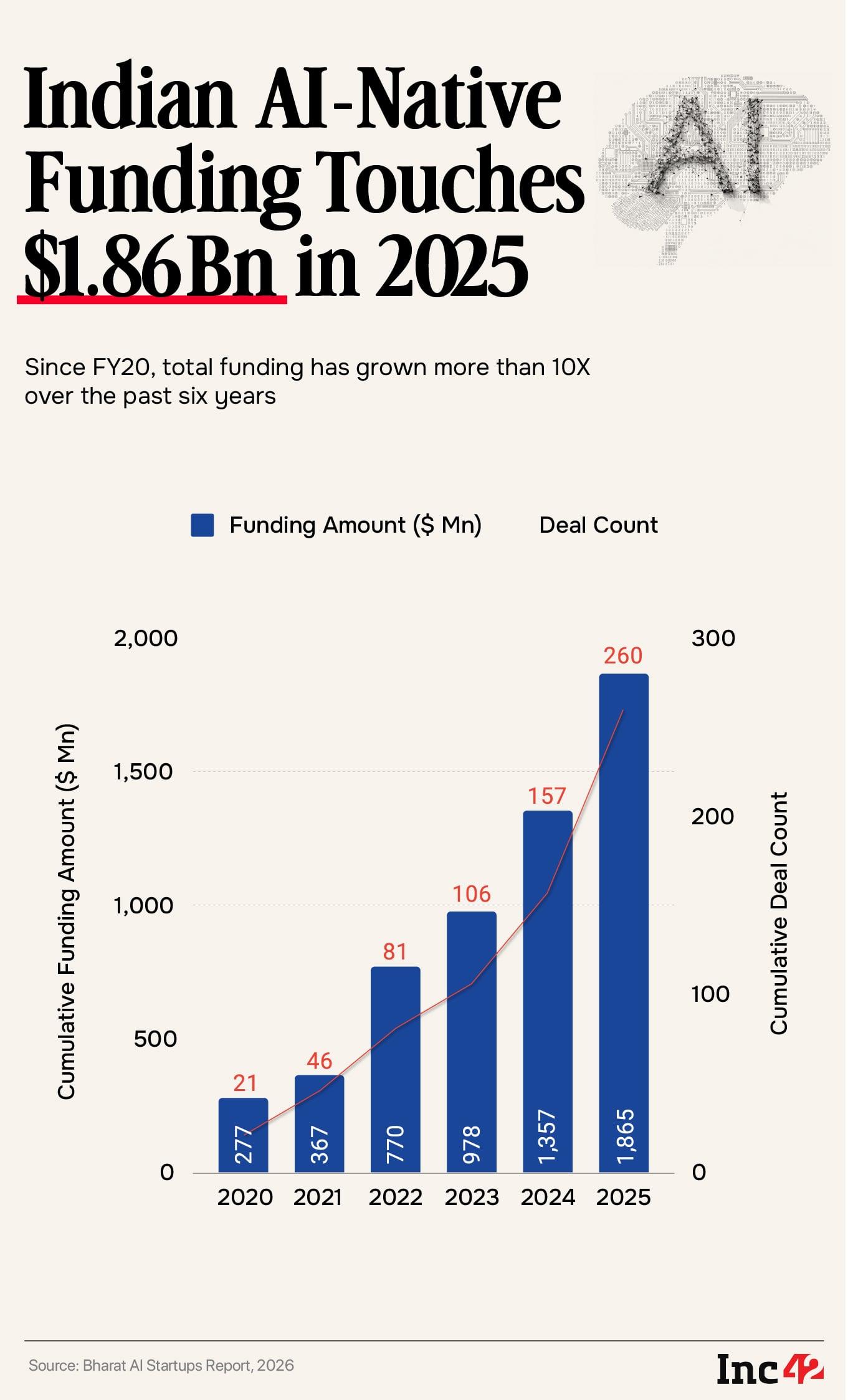

Collectively, AI startups raised over $1.5 Bn in 2025 alone, with the majority of capital flowing into application-layer and workflow-focused businesses, rather than speculative infrastructure plays.

At the foundational layer, a small but ambitious group of startups is attempting what few ecosystems outside the US and China have: building large models tailored for domestic realities.

Startups such as Sarvam AI and Gnani.ai are developing Indic-language large language models (LLMs), speech and voice models, and agentic systems designed specifically for Indian data, accents, regulatory constraints, and enterprise use cases.

Above this layer, voice and conversational AI has emerged as India’s clearest AI wedge. Startups including Navana AI, Observe.AI, Arrowhead, and Avaamo are already embedded deep inside BFSI workflows, powering lending, collections, sales, and customer operations at scale.

The strongest momentum, however, is at the application layer. Most startups are leveraging foundation models and cloud infrastructure, often accessed via domestic or government-supported platforms, to build vertical AI tools for enterprises.

These solutions range from explainable AI clouds and regulated-sector models for BFSI, to healthcare diagnostics, video and media generation, adaptive gaming systems, and AI tutors for education.

Despite this growth, Indian startups remain far behind their global counterparts.

“The total AI funding in India is roughly equivalent to half a day of AI funding in the US,” says Shayak Mazumder, founder and CEO of Adya.ai. “There is no comparison. No Indian organisation, no research ecosystem, no university system is currently capable of competing at that level.”

According to him, India’s current trajectory, focused on smaller, domain-specific models and application-layer innovation, may be more pragmatic, but it is also more limiting.

However, while startups continue to innovate within these niches, the pace of adoption across Indian enterprises remains slow. Many companies are still evaluating AI’s potential through pilots and proofs of concept, rather than deploying full-scale solutions, which limits both market learning and the feedback loops necessary for model improvement.

Snowflake data shows only about 23% of the Indian enterprises have fully integrated AI into their overall strategy.

This trend is also evident across startups in India. According to Inc42 data, while most startup founders are optimistic about AI spending, only 10% of startups invested over INR 1 Cr in AI in 2025.

“India has invested tremendous effort in building sovereign models, but that effort will be wasted without sovereign distribution. OpenAI and Google are aggressively expanding across the Indian market, competing for control of distribution. If we don’t rapidly establish large-scale, India-owned distribution, we risk losing access to Indian user data and the feedback loops essential for training better models,” says Siddharth Bhatia, founder and CEO of Puch AI.

This gap between ambition and execution highlights the challenges Indian startups face in scaling their innovations beyond early-stage applications.

Moreover, enterprise-grade AI adoption has not truly begun. Beyond general-purpose LLMs and consumer-focused applications, most companies are still stuck at POC and pilot stages, according to Sabharwal.

Investors Ready For AI Revolution

Our thesis is that investors are not betting on foundational model breakthroughs or infrastructure moonshots but on execution, product makers and founders. Startups leveraging AI to create a solution to an Indian problem at scale will be a big attraction for investors.

According to Inc42’s findings, the 2026-2030 window is the highest-leverage founding window before consolidation raises the cost of user acquisition and market expansion.

The post National Startup Day 2026: AI Finds Its Moment appeared first on Inc42 Media.

from Inc42 Media https://ift.tt/YgH6ueJ

via

0 Comments